Plummeting stock market travels into the New Year

As 2018 came to a close, the stock market saw its worst month during December since the Great Depression of the early twentieth century. Analysts attribute the market’s lack of success in December to America’s trade war with China, interest rates, and uncertainty in American government policy, according to washingtonpost.com. The market’s start to 2019 is the worst start to a new year since 2000, with Apple Incorporated recording strikingly depressed numbers this month, according to marketwatch.com.

In September 2018, firms in the Standard & Poor’s 500 (S&P 500), a stock market index that includes the 500 largest companies by market capitalization, expected to report fourth-quarter earnings 17 percent higher than they were in 2017, according to wsj.com. At the end of the year, this number ended up being closer to 11 percent. US stocks lost roughly $2.9 trillion in value during December, according to cnbc.com.

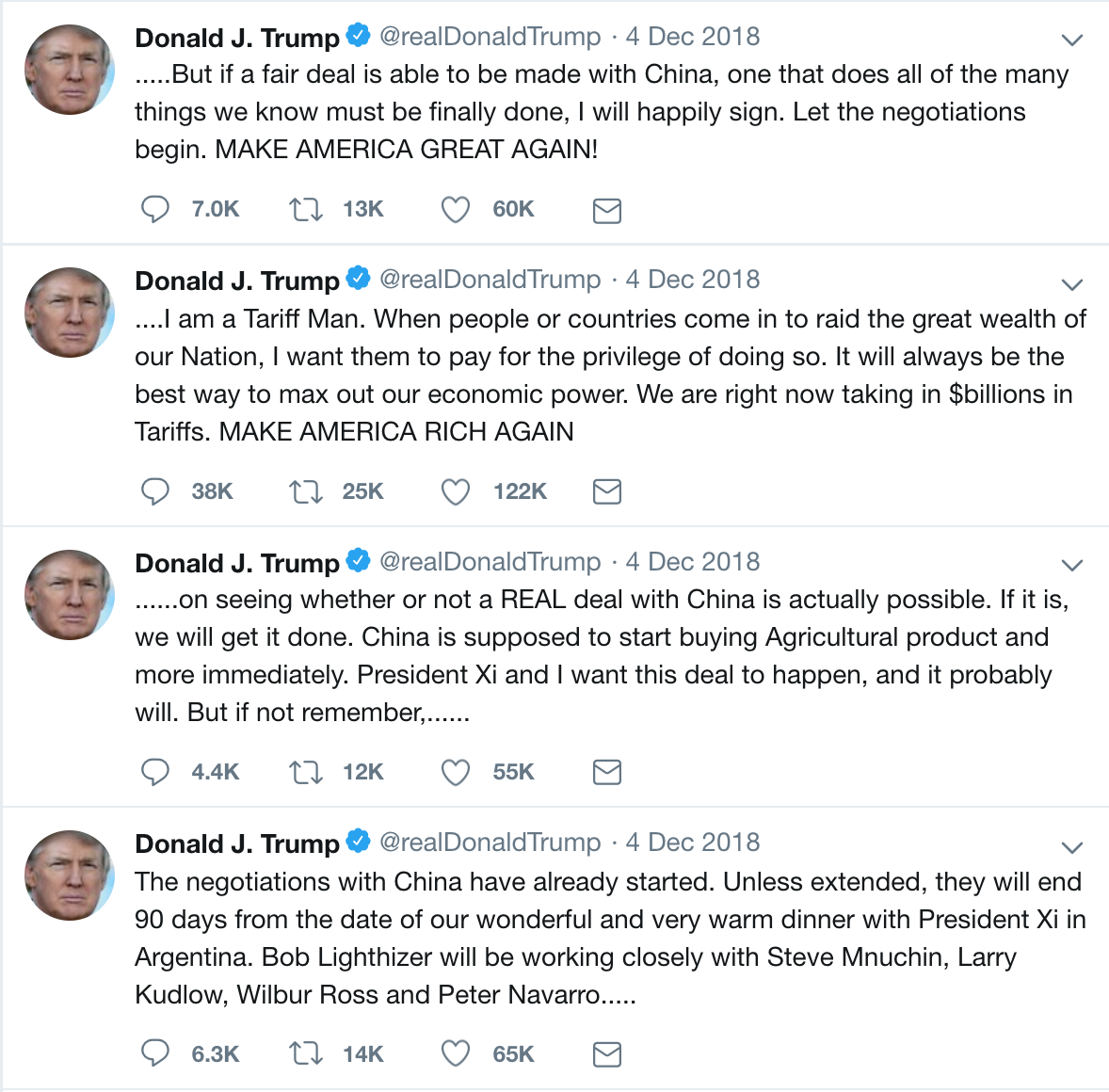

The most noticeable topple of the markets began December 4, when President Mr. Donald J. Trump posted a tweet about tariffs, according to washingtonpost.com. After Mr. Trump’s statement, S&P 500 dropped 3 percent. Overall, from October 2018 to December 2018, the market dropped nearly 20 percent without slowly rising back up until the new year, according to cnn.com.

Mr. Trump and Mr. Xi Jinping, President of the People’s Republic of China and General Secretary of the Communist Party of China, failed to make a trade deal during a meeting at the beginning of December 2018, forcing the two leaders to create a 90-day timeline to form an agreement, according to The New York Times. America and China have put substantial tariffs on each other’s goods, shifting the market to its largest decline in a decade, according to washingtonpost.com.

Members of the Sacred Heart Greenwich community shared their opinions on Mr. Trump’s decisions and the impact it had on the stock market. Among them is Mr. Vincent Badagliacca, Upper School History Teacher and Chair of History Department.

“The tariff threat has worked to allow negotiation of a new ‘free-er’ trade agreement with Canada and Mexico. China, however, is proving to be a more difficult challenge,” Mr. Badagliacca said. “China has achieved extraordinary growth by taking advantage of our country and, frankly, by stealing the technology of its trade ‘partners.’ Quite understandably, China doesn’t like the fact that it is being told it can no longer behave in that fashion. We’ll need to wait and see if the president’s strategy will yield success with that nation.”

With time left for the two global leaders to determine a deal, the stock market’s poor end to 2018 made its way into 2019. At the close of the market Thursday, January 3, Apple Inc.’s stock value fell 10 percent, which is the company’s biggest percentage drop since 2013, according to marketwatch.com. Apple accredited this loss to poor economic activity in China. Mr. Timothy Cook, Chief Executive Officer (CEO) of Apple Inc., sent a letter to the company’s investors Wednesday, January 2, explaining the dramatic decrease in stock value.

“While we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China,” Mr. Cook said, according to marketwatch.com.

Mr. Cook further explained that almost 20 percent of Apple Inc.’s revenue comes from the Greater China region, specifically Hong Kong and Taiwan. Additionally, Mr. Cook noted that fewer customers than anticipated chose to upgrade to Apple’s newest phones, according to marketwatch.com. Yet, the CEO remains optimistic and believes the company will continue to prosper.

“While it’s disappointing to revise our guidance, our performance in many areas showed remarkable strength in spite of these challenges,” Mr. Cook said, according to marketwatch.com.

Since the drastic fall in December, the market is looking to make a comeback in January. So far, for the week of January 14, the S&P 500 rose 2.4%. This minor improvement was made possible by progressing trade talks between China and the United States, according to zacks.com. Mr. Badagliacca is hopeful this steady rise will continue throughout the year.

“Since his election, though volatile, with some sharp spikes and dips, overall, the stock market is decidedly up,” Mr. Badagliacca said. “The Dow Jones Average and the S&P 500, two major indices, are up 21% and 31% respectively. Since most people, including the middle class and blue-collar union and even federal workers, rely on the market to grow their retirement savings, or to pay for the college education of their children, those percentages are welcome news.”

Featured Image by Sydney Gallop ’20

Sydney is thrilled to return to the King Street Chronicle for the 2019-2020 school year as Co-Editor-in-Chief. Moving forward from her previous position...